Online investment scam Ho Gaya? Ab Kya Karein? 🤯

Let’s be real. Online investment scam are everywhere these days. Har doosre din kisi ka paisa WhatsApp group, fake investment app, ya ek random “lottery message” se chala jaata hai. Aunty ji ka ₹50,000 gaya “lucky draw” mein. Bhaiya ka ₹2 lakh gaya “double returns” ke promise mein. And guess what? Most people never report it! 😢

But not anymore. This blog is your 2025 ka guide to fight back! 💪

Common online investment scam You Must Know 🕵

Before we learn to report fraud, thoda samajh lete hain kaun kaun se scam chal rahe hain:

1. WhatsApp Online Investment Groups 📱

- “Sir, invest ₹10,000 and get ₹15,000 in 3 days.”

- Fake charts, testimonials, and profits shown

- Jab withdrawal ka time aata hai: Block kar diya jaata hai 🙃

2. Job Scams 💼

- “Pay ₹1,000 registration fee for work-from-home job.”

- Or fake interview calls asking for “security deposit”

- Paisa jaane ke baad, number not reachable 😞

3. Lottery & Lucky Draw Frauds 🎰

- “You won ₹25 lakh in KBC! Just pay ₹5,000 to claim.”

- Aunty ko laga asli hai… bas yeh last payment hai

- Phir 3 aur payments, aur paisa gaya!

4. OTP / UPI Fraud 🔐

- “Bank se bol raha hoon, apka account block ho gaya hai”

- OTP liya aur bank balance zero 😡

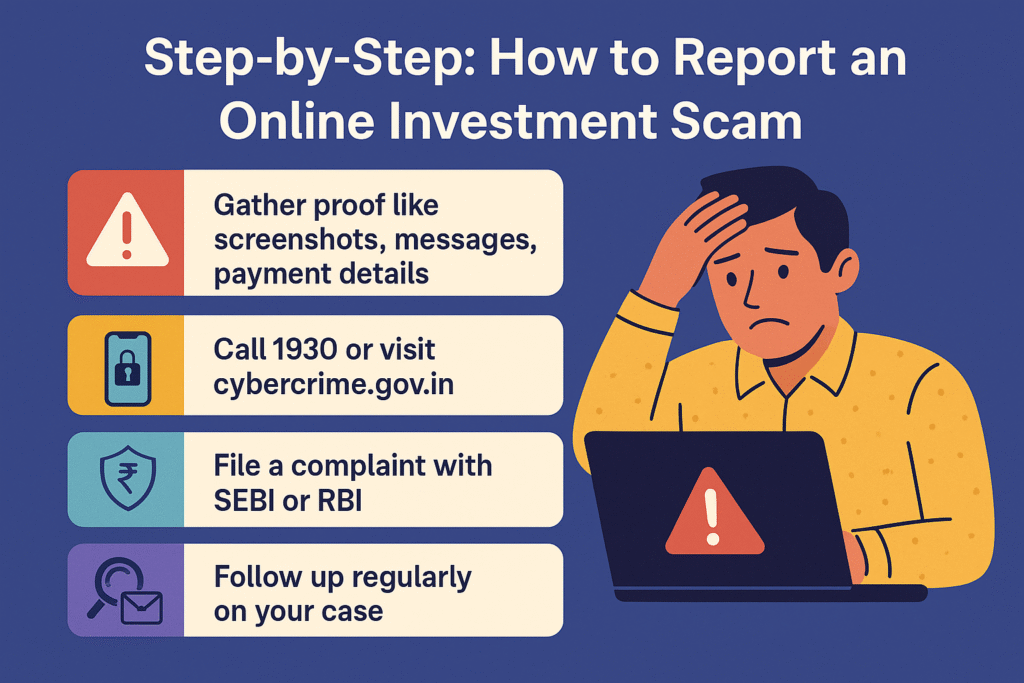

Step-by-Step: How to Report an Online Investment Scam 🧾

STEP 1: Collect Proof 🕵

- Take screenshots of messages, fake apps, websites

- Note down phone numbers, UPI IDs, email IDs

- Save payment receipts (Google Pay, Paytm etc.)

STEP 2: File Complaint on Cybercrime Portal 🖥

- Visit: https://cybercrime.gov.in

- Click on “Report Other Cybercrime”

- Select “Financial Fraud”

- Fill in details: What happened, when, how much paisa gaya

- Upload all proofs/screenshots

- Submit the complaint

- You’ll get a complaint number — save it 🙏

STEP 3: Call Cybercrime Helpline (1930) 📞

- Call 1930 (works 7am to 11pm, all India)

- Explain the fraud — in Hindi/English, simple language

- Share UPI ID, phone number of fraudster, your bank details

- If you act quickly, recovery chance hoti hai!

STEP 4: Inform Your Bank Immediately 🏦

- Visit or call your bank branch

- Give them the complaint number from cybercrime portal

- Ask them to freeze the transaction if still pending

- Most banks have a 24×7 fraud reporting helpline

STEP 5: File Local Police Complaint (FIR) 🚔

- Go to your nearest police thana

- Carry printed proof + cybercrime complaint number

- File FIR (mention sections: IT Act, IPC 420)

- Ask for a copy of FIR — yeh kaam aayega insurance/claim ke liye

Bonus Step: Report to SEBI (If Related to Stock/Investment Scam) 📈

If scam related to stock market, fake broker, or investment tips, then:

- File complaint on https://scores.gov.in

- This is SEBI’s official grievance portal

Also check: https://www.sebi.gov.in/intermediaries.html to verify if advisor/broker is registered or fake.

Don’t Fall for These Emotional Tricks 😢

Scammers are smart psychologists! They know how to trigger your:

- Greed (Double paisa in 5 days)

- Fear (Bank block ho gaya)

- Trust (Fake ID: SBI manager, SEBI officer)

- Urgency (“Abhi karo warna offer chala jaayega”)

👉 Har baar socho: “Kya yeh sach mein itna easy hota hai paisa kamaana?”

Real-Life Story Online Investment Scam : Aunty vs Scammer 😳

Mrs. Sharma (age 58) got a call: “Aapka number lucky draw mein select hua hai — ₹25 lakh jeeta hai!”

Aunty paid ₹5,000 tax. Then ₹15,000 more for “processing”. Scamster bola: “Ab last ₹10,000 aur dijiye.”

Tab tak Sharma uncle ne samjha diya — and she called 1930. Complaint file hua. Money toh nahi mila, par scam band ho gaya aur aur log bach gaye 🙏

Moral: Late ho, lekin report karo!

Be Alert, Not Afraid 🚨

Digital duniya mein frauds hote hain — lekin aap bewakoof nahi ho agar aap scam ka shikaar hue ho. Yeh galti har kisi se ho sakti hai. Farak tab padta hai jab aap action lete ho!

Do’s & Don’ts (Quick List)

✅ Do:

- Save all proof, report immediately

- Talk to family, don’t hide it out of shame

- Share cybercrime number 1930 with elders

❌ Don’t:

- Don’t share OTP with anyone

- Don’t pay “taxes” or “fees” to get rewards

- Don’t invest just because someone showed you a screenshot