“Sir, double ho jayega paisa” — The Sweet Trap ₹

“Bhaiya, ek scheme hai… 25,000 invest karo, 50,000 ban jaayega 6 mahine mein.”

Sounds familiar? Chances are, either you or someone in your family has heard this line — maybe from a friend, neighbour, or even a WhatsApp group. This is the starting line of many Ponzi schemes that are spreading like wildfire across India. Especially targeting middle-class families, these scams play with your trust, your dreams of earning more, and your lack of technical knowledge.

In this blog post, we’ll explain what Ponzi schemes are, why they work so well, and how you can stay safe. No heavy financial jargon, bas simple baat. Let’s get started. 😊

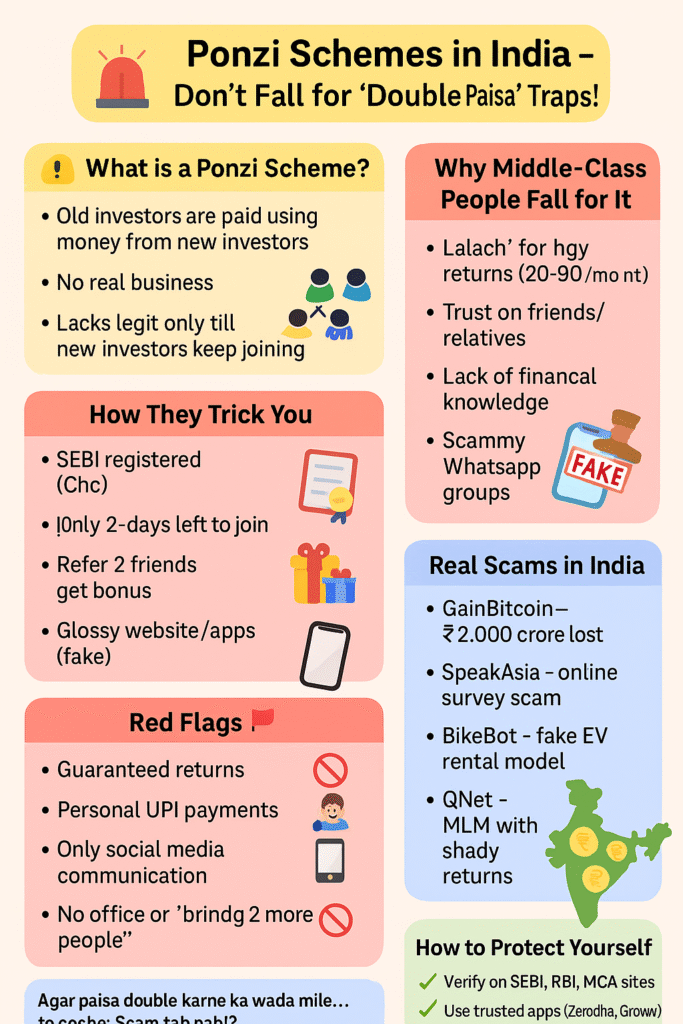

What is a Ponzi Scheme?

In simple terms Ponzi scheme India:

A Ponzi scheme is a fraud where old investors are paid with new investors’ money.

There is no real business. No actual profit. Sirf ek chain chalti hai:

- Aap paisa lagate ho (say, ₹50,000)

- Company promises “double return” in 6 months

- Wo return aapko kisi naye investor ke paison se dete hain

- Jab naye investors milna band hote hain, poora system collapse ho jaata hai

Example:

Rajesh invested ₹1 lakh in a company that promised 20% monthly return. Pehle 2 mahine regular paisa aaya. Third month, nothing. Phone band, office locked. Total loss: ₹1 lakh.

Why Middle-Class People Fall for Ponzi Scheme India

1. High Return Ka Lalach 💰

“Bank sirf 6% deta hai, yahan 24% mil raha hai!”

When someone sees a chance to earn more, that too quickly, they don’t want to miss it. Especially middle-class people who are:

- Saving for children’s education

- Paying EMIs

- Managing household budgets

They think: “Ek baar try karke dekhte hain…”

2. Word of Mouth Trust

“Aunty ne invest kiya hai, unko paisa mila hai.”

When friends or relatives are already getting returns, hum unpe bharosa kar lete hain. We forget to ask: Where is the money actually coming from?

3. Lack of Financial Awareness

Most people don’t know how safe investments work. SIP kya hota hai? SEBI kya karti hai? Bonds kya hote hain? Jab knowledge nahi hoti, to scamsters easily fool you with big words and fake documents.

4. Desperation After Job Loss or Emergency

COVID ke baad ya kisi emergency ke time, log jaldi paisa kamaane ke chakkar mein scam ka shikaar ban jaate hain.

5. Fear of Missing Out (FOMO) 🚨

“Bas last 3 din hain entry ke. Late hua to waitlist.” Scamsters use urgency to trap you.

How They Trick You: Common Ponzi Tactics 🧨

- “Government registered” claims: They show fake GST or SEBI documents

- Glossy websites and apps: Looks professional, but 100% fake

- Fake testimonials: “Sharmaji from Delhi earned ₹50,000 in 10 days”

- Referral commissions: “Bring 2 friends and earn extra”

- WhatsApp groups: With fake success stories, screenshots, and charts

- Office tours: Ek temporary office setup karte hain to look legit

Real-Life Examples 📅

1. Bike Bot Scam (UP)

Promised high returns by investing in electric bikes for rentals. Thousands of people invested. Total scam worth over ₹1000 crore!

2. Speak Asia Online

Fake online survey company that promised money for filling surveys. Lakhs of people lost money before it was shut down.

3. QNet Scam

High-profile MLM-type scheme that still exists in many forms. Many celebrities even got involved unknowingly.

4. GainBitcoin Scam

Promised Bitcoin returns. Leader Amit Bhardwaj looted ₹2,000 crore+. No real crypto mining was happening.

5. Stock Guru India

Promised 20% monthly returns. Over 2 lakh people lost their savings.

Red Flags to Watch Out For ⚠️

Always ask yourself:

- ❌ Are they promising guaranteed returns? (No legit investment does that)

- ❌ Are they asking for payment via UPI or personal accounts?

- ❌ Are they operating mostly on WhatsApp/Telegram only?

- ❌ Is there no physical office or just a rented flat?

- ❌ Are they saying “Only 2 days left to invest”?

- ❌ Are they pushing you to bring more people?

If the answer is YES to even 2 of these → RUN!

How to Protect Yourself (Bachav ka Formula) 🛡️

1. Research Karo

Check company details on:

2. Bade Returns? Badi Soch!

If the return is too good to be true, it probably is.

3. Don’t Trust Screenshots

Fake profit screenshots can be made in 5 minutes. Ask for audited statements, not chats.

4. Use Only Trusted Platforms

Apps like:

- Groww

- Zerodha

- Paytm Money

- SBI Mutual Fund

These are regulated and safe.

5. Educate Family Members

Elders often become victims. Explain things in simple terms and make them cautious.

6. Report the Fraud

- Visit: https://cybercrime.gov.in

- Call helpline: 1930

If You Are Already a Victim of Ponzi scheme India: Kya Karein?

- Don’t stay silent: It’s not your fault. Report karo.

- Gather proof: Chat screenshots, payment slips, account details

- Report to cybercrime cell

- Inform others so they don’t fall for the same trap

Easy Way to Remember: SCAM ka Full Form 🔮

S — Soch samajh kar invest karo

C — Check credibility

A — Ask questions

M — Mat bhoolo: paisa kamaana aasaan nahi hota!

Final Thoughts: Awareness Is Your Best Defence ✅

Scamsters har roz naye tareeke nikalte hain. But agar aap thoda alert ho jao, basic cheezein samajh lo, to aap apne paise ko secure rakh sakte ho.

Don’t let greed blind you. Don’t fall for urgent calls or sweet promises.

Har baar jab koi bole, “Sir paisa double ho jaayega…” bas ek baar soch lena:

“Agar itna easy hota to sab rich hote na?”