Namaste Doston 🙏. Have you ever received a message saying:

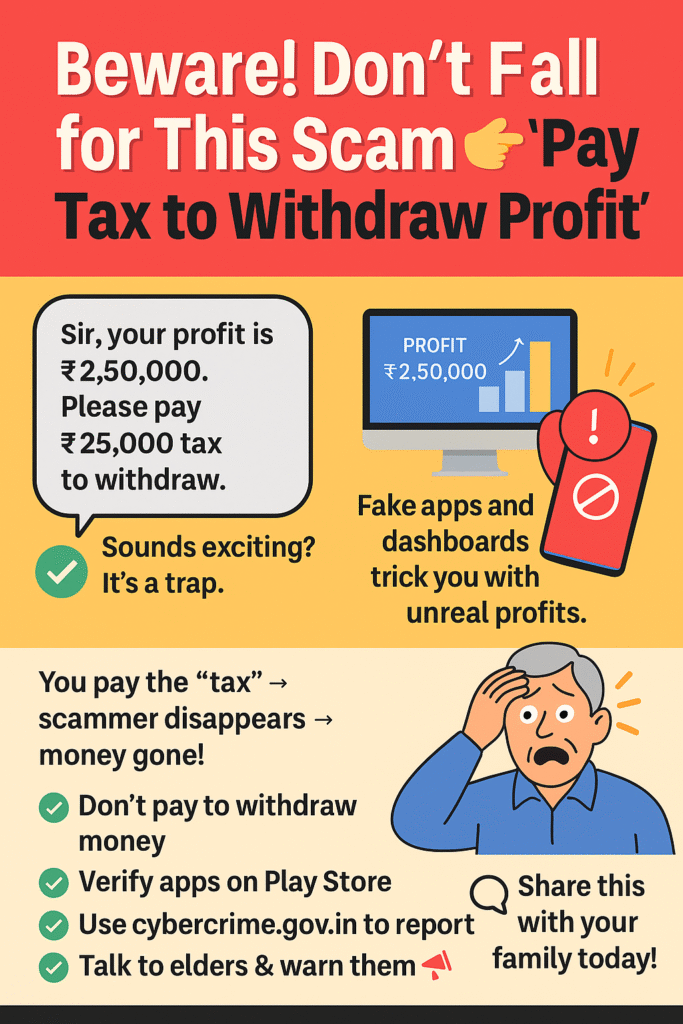

“Congratulations! Aapka investment 10X ho gaya hai. Please pay 10% TDS to withdraw your profits!”

Sounds exciting, right? But doston, this is a scam. A very dangerous one. It is called the “Pay Tax to Withdraw” fraud, and thousands of people in India — especially middle-class and retired folks — have lost their hard-earned money this way.

Let me explain in very simple language how this fraud works, real-life examples, and how you and your loved ones can stay safe.

How This Scam Works ⚖️

Fraudsters play a very clever game. Here’s their step-by-step formula:

- Contact via WhatsApp, Telegram, or Facebook

- They act like a stock market expert or investment agent.

- They add you to a “trading group” full of fake members showing daily profits.

- Make you invest small amounts

- “Sir, invest ₹1000 and see the magic!”

- They show fake profits and say: “Aapke ₹1000 ab ₹1200 ho gaye!”

- Create fake dashboards or apps

- The app or website will show increasing profits.

- It looks real but sab kuch nakli hota hai.

- Ask for bigger investment

- “Invest ₹50,000 to get ₹1.5 lakh next week.”

- You trust them (because fake profits dikha diye) and invest more.

- The trap: “Pay tax to withdraw”

- “Sir, your profit is ready. But government TDS of ₹15,000 needs to be paid first.”

- You pay.

- Then they say: “Now pay processing fee.”

- Then they block you.

In short: Pehle profit dikhate hain, fir paisa le kar bhag jaate hain.

Real-Life Example: Mrs. Sharma from Delhi 🌆

Mrs. Sharma, a retired school teacher from Delhi, got added to a WhatsApp group called “Safe Returns Club.” It looked professional. She saw messages like:

“Thanks Ramesh ji, just got ₹50,000 profit today!”

Encouraged, she invested ₹5000. Next day, the app showed her balance as ₹12,500! She was impressed.

Then came the trap:

“Ma’am, your profit is ready. Just pay 10% tax (₹1,250) to withdraw.”

She paid. Then another message:

“Ma’am, now a processing fee of ₹500 is pending.”

She paid again. And then…

Blocked. Gone. Sab paisa gaya.

She lost ₹1750 in total. Seems small? Some people lose lakhs.

Why People Fall for It 🤔

- Greed + Trust: They show you fake profits. Aapko lagta hai “achha return mil raha hai.”

- Group Pressure: WhatsApp group ke messages dekh ke lagta hai sab genuine hai.

- No Digital Awareness: Scam detection tools ya safety ka knowledge nahi hota.

- Fear of Missing Out (FOMO): “Aaj invest karo, kal se slots close.” You rush.

Common Red Flags ⚠️

Always remember these signs:

- “Guaranteed returns” ₹₹20%

- WhatsApp only communication

- UPI ID belongs to personal account, not company

- Asking for money to release money

- App or website not on Play Store

- Pressure: “Last chance sir!”

- No official emails or contact number

If you see 2 or more of these signs, RUN AWAY! 🏃

7 Ways to Stay Safe 🚨

- Never pay to get money

- Real financial institutions deduct TDS, they don’t ask you to pay it in advance.

- Ignore unknown WhatsApp groups

- Even if logo aur screenshots genuine lagte hain — scam ho sakta hai.

- Check UPI account names

- Company ka naam hona chahiye, personal name toh red flag hai.

- Install only verified apps

- Sirf Google Play ya Apple Store se hi download karein.

- Report suspicious messages

- WhatsApp pe “Report” button hota hai — use it.

- Educate family & elders

- Aapke parents, uncles, retired relatives are most vulnerable.

- Use Cybercrime Portal

- cybercrime.gov.in pe complaint file karo.

- Ya call 1930 helpline.

What To Do If You Got Scammed? ❌

- Take screenshots of all chats and payments

- Note down UPI ID / Bank Account

- Report to cybercrime at cybercrime.gov.in or Call 1930 – National Cyber Crime Helpline

- Call your bank & request freeze on further transfers

- Inform local police station with FIR

Itna sab karne ke baad bhi paisa wapas aaye ya na aaye, but your complaint stops the scammer from doing it to someone else.

Final Words: Be Aware, Not Afraid ✨

Internet is amazing. But just like real life, some people out there are chors in digital clothes. Bas thoda alert rahna hoga.

Agar aapko koi profit dene ke liye pehle paisa maange, toh yaad rakho:

“Yeh paisa kamaane ka tareeka nahi, paisa khona ka shortcut hai.”

So be smart. Ask questions. Don’t be in a hurry.

And please, share this post with parents, family groups, mohalla groups — anywhere people may need it.

Stay alert. Stay safe. 💡