“Bhaiya, mujhe ek SMS aaya tha ki maine 25 lakh ka lottery jeeta hai. Maine account details bhej diye. Ab toh paisa aayega na?”

This line, overheard at a local chai stall, may sound innocent. But sadly, it’s how many Indians lose their hard-earned money online every year. With increasing use of smartphones, UPI, and digital apps, fraudsters have also upgraded their tricks.

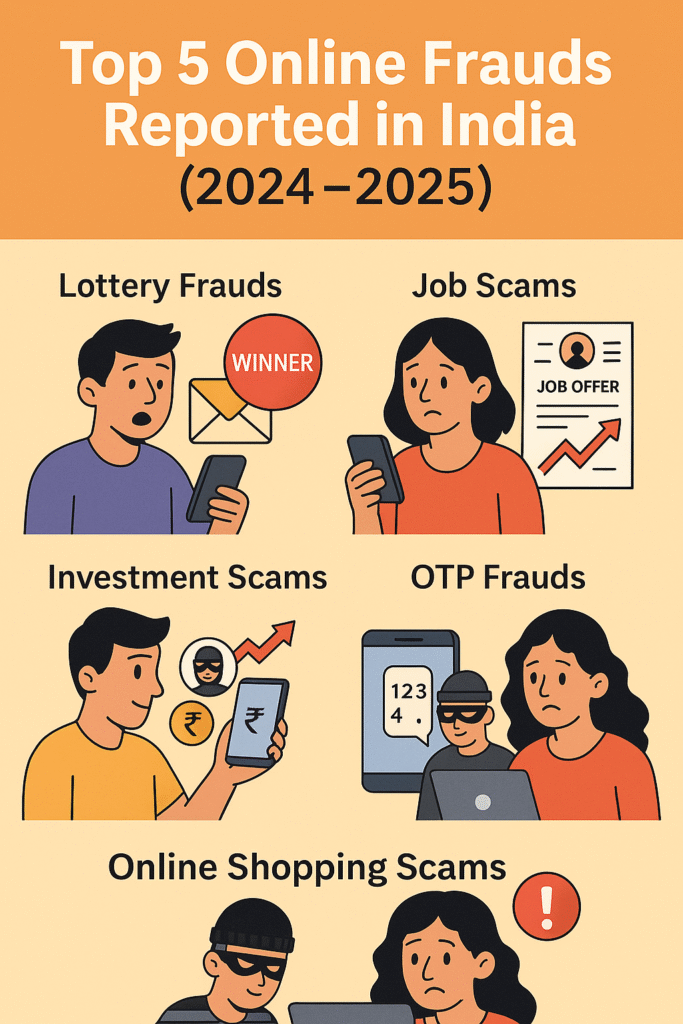

In this friendly guide, we’ll walk you through the Top 5 Online Scams reported in India in 2024–25, with real-style examples, how they work, and most importantly, how you can stay safe 🚀

1. OTP Fraud – “Sir, your KYC is pending…” 🚨

What happens? A scammer calls pretending to be from your bank or mobile provider.

“Sir, your KYC is expiring today. Send the OTP fast or your account will be blocked!”

People panic, share OTPs – and boom! ₹₹₹ is gone from your account.

Real-style example: Ramesh, a retired teacher from Kanpur, lost ₹90,000 after he shared an OTP with someone claiming to be from SBI.

How to stay safe:

- Never share OTP with anyone. Bank ho ya police, koi nahi maangta.

- Don’t panic with such calls. End call, call the official bank helpline.

- Enable SMS/email alerts for all transactions.

Pro Tip: Jahan “urgent” bola jaye, wahan “fraud” ka chance high hai! ⚠️

2. Job Scam – “You got the job! Just pay registration fee…” 🎓

What happens? Fake job portals and WhatsApp groups send offers to unemployed youth. “Data entry job”, “Work from home”, “Amazon job” etc. Once you show interest, they ask for a “registration fee” or “document processing charges.” After that, they disappear.

Real-style example: Priya from Jaipur got an offer to work with a “UK-based firm” via Telegram. She paid ₹1,500 as a joining fee. After payment, all contacts vanished.

How to stay safe:

- No legit company asks money for giving jobs.

- Always check job offers on official websites (LinkedIn, Naukri, etc.)

- Avoid jobs shared only via WhatsApp or Telegram.

Remember: Naukri lene ke liye paisa nahi, skills dene padte hain! ✅

3. Lottery & Lucky Draw Scam – “You won 25 lakh rupees!” 🎉

What happens? You get an SMS or WhatsApp message:

“Congratulations! You’ve won 25 lakh in Kaun Banega Crorepati Lucky Draw. Call this number now!”

The scammer then asks for taxes, fees, etc., to release the “prize money.”

Real-style example: Shyamlal from Patna paid ₹12,000 in various “GST” and “processing fees” thinking he had won a KBC lottery. But no prize ever came.

How to stay safe:

- KBC, Google, Amazon never do random lotteries.

- Don’t call back unknown international numbers.

- No real lottery asks you to pay money to claim money.

Golden Rule: If you didn’t participate, how did you win?

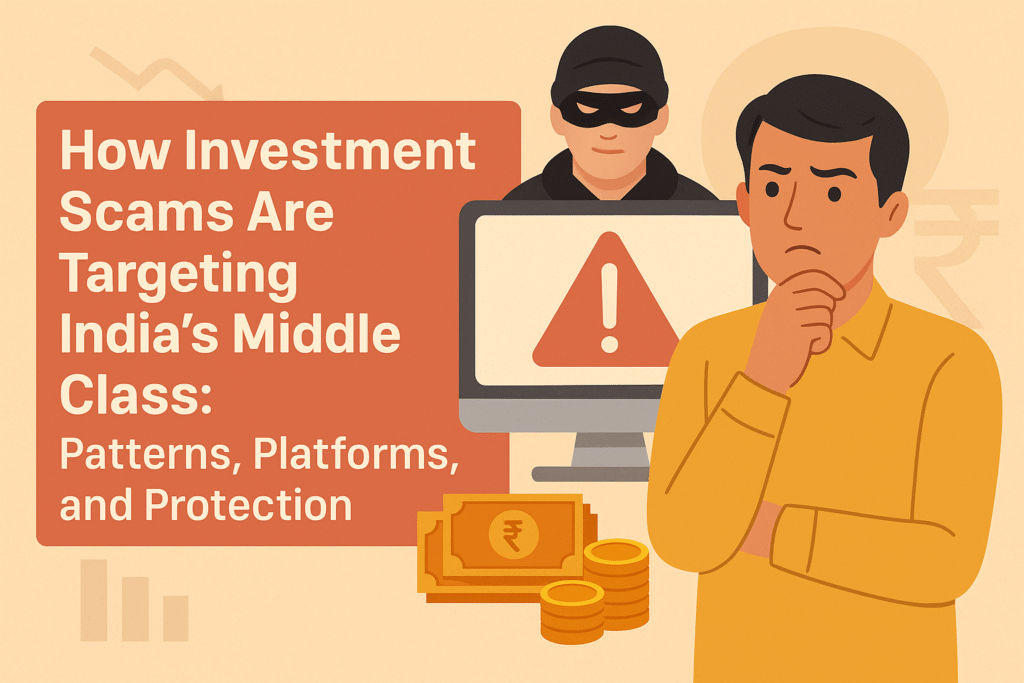

4. Investment Scam – “Double your money in 7 days!” 🚀

What happens? Fraudsters send messages or add you to Telegram groups showing high profits in crypto, stocks, or apps. They show fake screenshots like “₹5000 turned into ₹7000 in 1 day”. You invest more… and then, app stops working or you’re asked to pay tax to withdraw.

Real-style example: Suresh, a shopkeeper in Pune, invested ₹30,000 in a fake crypto app after seeing his friend earn (fake screenshots). When he tried to withdraw, the app asked for 10% “TDS”. After paying it, he was blocked.

How to stay safe:

- No investment gives 30% return in 3 days. Period.

- Never invest via unknown apps or links.

- Use official apps (Groww, Zerodha, CoinDCX, etc.)

- Check SEBI, RBI registration if unsure.

Ek hi formula yaad rakho: Jitna jaldi paisa double, utni jaldi double fraud.

5. Fake Customer Care – “Call this number for refund/support” 📞

What happens? You search online for a customer care number (Zomato, Flipkart, etc.) and call a number from Google or YouTube. But it’s a fraud number! The scammer pretends to help and slowly extracts your personal info, card details, UPI pin etc.

Real-style example: Anita from Bhopal searched “Zomato refund number” on Google. She called the first number she saw. The person on the other end tricked her into sharing her UPI PIN, and ₹49,000 was gone in minutes.

How to stay safe:

- Never trust numbers shown in random websites or videos.

- Go to the official app or website only.

- Don’t allow screen-sharing to strangers (like via AnyDesk, QuickSupport).

Tip: Jo aapke phone screen ka access maange, woh aapka bank account bhi le sakta hai!

Cybercrime Reporting & Helpline for Online scams ✉️

If you or someone you know has been scammed, don’t stay silent. Report immediately.

- Website: cybercrime.gov.in

- Helpline: Dial 1930 (24×7 working)

- Also inform your bank within 24 hours for possible reversal

Reporting helps stop scammers and protect others.

Quick Tips to Stay Digitally Safe ✨

- Never share OTP, PIN, CVV with anyone ❌

- Use strong passwords & enable 2FA

- Don’t install unknown apps or click on suspicious links

- Educate your parents and elders regularly

- Use UPI only with verified merchants

- Always confirm before sending money

Remember:

Online duniya safe hai, bas thoda sa alert rehna zaroori hai 🙏