Namaste doston! 👋 Aaj hum ek bahut hi important topic par baat karne wale hain — WhatsApp scam/Investment scams. Especially those that are trapping India’s middle-class families — log jaise aap aur hum.

Soch kar dekhiye — ek WhatsApp message aata hai: “Invest ₹5000 and earn ₹10,000 in 5 days.” Tempting hai na? Lekin yahi se shuru hota hai digital fraud ka khel. Aapka paisa, aapki savings, sab kuch zero ban sakta hai agar aap alert nahi rahe.

Chaliye simple language me samajhte hain ki ye scams kaise kaam karte hain, kya tricks use hoti hain, aur kaise bachav kiya ja sakta hai. 💡

Why Middle-Class Families Are Being Targeted

India’s middle class is hardworking, aspirational, and now increasingly digitally connected. They want better returns on savings, college funds for kids, retirement security — and that’s exactly what fraudsters exploit.

Scammers know:

- We want higher returns than bank FDs.

- We are learning online investing but are not experts.

- We often trust people who sound “professional”.

And this is where they enter the game. 🎯

Real-Style Example: WhatsApp Scam Share Market Group Scam

Ravi uncle, a retired school teacher from Meerut, got added to a WhatsApp group named “HDFC Stock Experts”. The group admin shared daily updates, tips, even screenshots of “profits” from other members.

After watching for 10 days, Ravi uncle invested ₹20,000, then ₹50,000, and finally ₹1.2 lakh. The app showed his portfolio was now worth ₹2.4 lakh!

But when he tried to withdraw it?

“Sir, please pay TDS of ₹12,000 to release the amount.”

He paid.

“Now pay ₹50,000 processing fee.”

And then… silence. The group disappeared. Admins vanished. Scam complete.

Lesson: Real companies never ask you to pay to withdraw your own profits. ❌

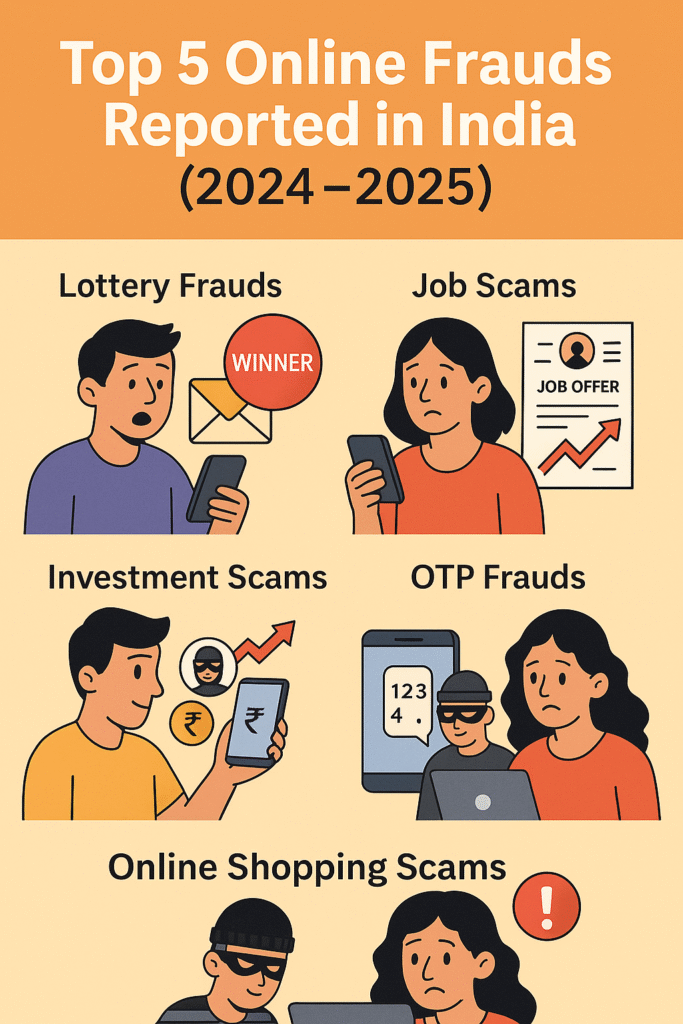

Common Types of Investment Scams/WhatsApp scam

Let’s look at the most popular fraud formats right now:

📱 WhatsApp/Telegram Stock Groups

- Promise guaranteed returns (20–50% in 7 days)

- Show fake screenshots of profits

- Ask you to install shady apps or send money via UPI

🧾 Fake Trading Apps

- Look like Zerodha, Groww, etc. but are clones

- Show dummy graphs, false profits

- Work fine until withdrawal, then freeze

💼 Job Offer Scams with “Task Investment”

- Found on Telegram, LinkedIn, Facebook

- Promise WFH part-time job + investment task

- Ask to “complete a task” by depositing money to earn commission

🎁 Lottery / Reward Fraud

- “Congratulations! You won ₹5 lakh lottery from Paytm”

- But first, pay GST/processing charge

- Then they vanish with your money

🏦 Fake Bank/SEBI Calls

- Impersonate bank managers or SEBI agents

- Ask for Aadhaar, OTP, or card PIN

- Use fear or urgency to trick you

Why Do People Fall for These?

- Greed & Hope: Jaldi paisa double karna hai

- Fear of Missing Out (FOMO): “Bas aaj ka offer hai”

- False Proof: Fake screenshots, testimonials, and logos

- Trust in tech: If the app looks real, it must be real — right? ❌

Scammers are good actors. They know how to talk, how to sound professional. Unke words hotey hain: Sir, we are SEBI registered… or Madam, this is a government scheme…

Signs That It’s Probably a Scam 🚩

If it sounds too good to be true, it probably is.

Watch out for:

- “Guaranteed returns” above 15%

- No physical address or office

- UPI to personal account

- No proper customer care number

- Group admins avoid video calls

- Asking for money to release your own money

Real-Life Fraud Alert: Mumbai Homemaker Lost ₹7.8 Crore

A recent case involved a 62-year-old lady who trusted a fake trading group. She kept investing, kept paying “fees” to withdraw, and ended up losing her entire life savings.

Source: NDTV Report

Aap bhi kisi ke parent, bhai-behen, ya friend ho sakte ho jise yeh blog bachaa de. So do share it 🙏

How to Stay Safe (Bachav Tips) 🛡️

✅ Before You Invest:

- Always verify SEBI or RBI registration: sebi.gov.in

- Search company name + “scam” on Google

- Don’t trust random Telegram/WhatsApp groups

- Talk to someone you trust before transferring money

❌ Never Do This:

- Don’t share OTPs, Aadhaar, PAN with strangers

- Don’t install apps from links sent on WhatsApp

- Don’t pay money to get lottery, prize, or refund

- Don’t transfer funds to personal UPI IDs

📞 If You Smell a Scam:

-

Reporting a WhatsApp scam: Step-by-Step

- Collect all evidence: Screenshots, account numbers, chat records.

- Report to cybercrime.gov.in

- Call 1930 – National Cyber Crime Helpline

- Email your bank’s fraud desk immediately

- File a police complaint (FIR) at the nearest station

You can also report to:

Empower Yourself, Don’t Be Afraid 💪

The idea is not to get scared of investing or using digital platforms, but to become smart and alert. Jaise seatbelt lagate ho car me, waise hi digital safety ka bhi ek routine banao:

- Think before you click 🖱️

- Pause before you pay 💸

- Talk before you trust ☎️

Aapka ek savdhaan step aapki puri savings ko safe rakh sakta hai. 🙏

Final Thought 💬

Dost, scammers har jagah hain. Lekin agar hum digitally aware ho jaayein, toh unka jhaansa chal hi nahi sakta.

So the next time someone promises quick returns or says, “Sir aapka paisa double ho jayega 5 din me…” — just smile and say:

“Mujhe pata hai ye scam hai. Aap apna time waste mat karo.”

Stay smart. Stay alert. Stay safe. 🙌